Key Takeaways

- GDP shrank by 0.3% in Q4 of 2023, tipping the UK into a technical recession

- This increased conviction amongst investors that the Bank of England would cut interest rates this year, which pushed the UK market up by 0.75% in a day

- With 2-year UK yields offering around 4.6% this represents a good opportunity for income and for capital growth once rates start to come down

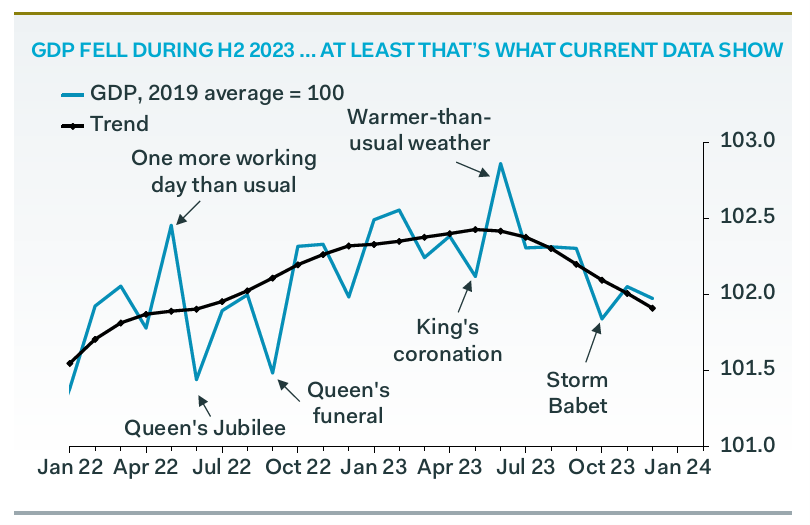

According to economic data announced yesterday, the UK slipped into a recession in the second part of last year. The fourth quarters contraction in GDP was sharper than the markets 0.1% expectations coming in at 0.3% and puts economic output 1% higher than pre-COVID levels. In terms of peers, this means that UK joins Japan among the G7 countries advanced economies in recession. To add some context to these figures; since the start of the 70’s the UK has experienced six recessions. The most infamous recession in recent history is perhaps the global financial crisis, whose fallout took five years to recover after the economy shrank by over 6%.

Though this news may seem gloomy, there are silver linings. The recession is expected to be relatively shallow, and we may already be near the end of it. Financial markets have also reacted positively as the likelihood of early summertime interest rate cuts increases, causing enthusiasm. The data also cements our view that interest rates are on a downward trajectory, but we expect cuts at a slower rate than the market predicts. Due to this, a notable opportunity that we have taken advantage of is with short duration UK bonds.

Why do we think the Monetary Policy Committee (MPC) won’t make a snap decision around lowering interest rates off the back of the recession news:

- GDP is normally subject to upward bias revisions

- Employment continued to rise in Q4, and real wages picked up too

- The GDP difference to forecast was largely due to real government expenditure reduction (0.4% lower than anticipated)

- Consumer and business confidence is rising and suggests GDP could be positive for Q1 2024

Source: Pantheon Macroeconomics

What is a short duration bond?

This is essentially a debt security that takes a short time to repay your initial investment, usually defined as a five-year period or less. For coupon paying bonds, duration will always be lower than time to maturity as income forms part of repaying the initial investment. These bonds have more certainty of return as the principal is repaid in the near future – and can be reinvested into other opportunities more quickly.

The opportunity

The correlation of interest rates and risk assets, namely equities might be about to change. Given this potential, we believe that short duration fixed income can act as an income producing diversifier within managed portfolios. Credit spreads remain negatively correlated to rates at present, and we believe the strength of that relationship will grow when the yield curve normalises and quantitative tightening begins. Valuation differentials remain elevated in high yield debt versus investment grade. Yes, credit spreads across the quality spectrum have narrowed this year producing above-coupon returns, but credit market corrections have typically come at times when leveraged credit valuations have been far more compressed than present.

Bowmore portfolios

We’ve recently increased our exposure to short duration corporate credit as we believe that interest rates won’t fall quite as quickly as the market is predicting. This allows us to take advantage of the higher coupons on offer and eventual capital uplift that cannot be found at longer maturities. If a serious recession was presenting itself, we would expect interest rates to be cut by 0.5% or 1% and would look to allocate to longer dated government bonds. However, the mild weakening of the economy suggests the MPC will keep rates higher for longer.

Production

Production