Sustainability

INVESTMENT DECISIONS TODAY THAT SHAPE THE WORLD OF TOMORROW

At Bowmore, we believe your client’s investment strategy should reflect not just their objectives when it comes to performance but also their personal values and principles.

For many clients, those values and principles are shaped by concerns about the future of the planet and the way we treat our fellow humans.

If your clients are concerned about the health of the world their children and grandchildren will inherit, then you may want to help them build an ESG portfolio.

An ESG approach to investing seeks both strong financial returns and positive environmental and social change.

OUR ESG PROPOSITION

Positive changes in these areas will help to address

the worlds sustainability and social challenges.

How do we do it?

STREAMLINED PROCESS

The Investment Process for Bowmore’s ESG portfolios is very closely aligned to the process used for our core mandates. Asset allocation is dictated by our asset allocation committee, who meet on a quarterly basis and take a short and long-term view of markets and macro- economic events to establish the asset allocation in portfolios.

POSITIVE SCREENING

We aim to strike a balance that provides a rigorous ESG screening process whilst not compromising investment performance (using a positive screening process). We search for companies that already align to our ESG principals, who are making progress and significant investment in order to ensure that the business improves it sustainability score in the future.

ESG & SRI FLAGGING

We use various financial data providers that give us a vast amount of investment information and detail on investable securities. For the ESG fund selection process, we first utilise ESG and SRI (Socially Responsible Investing) flags to shrink the larger universe down to ethically focussed funds.

Making an impact

How your clients invest their money could have a far bigger impact than they realise. For example, did you know that making a pension green is 21 times more powerful than some lifestyle choices like minimising flying, turning vegetarian or switching energy provider

*Source: www.makemymoneymatter.co.uk

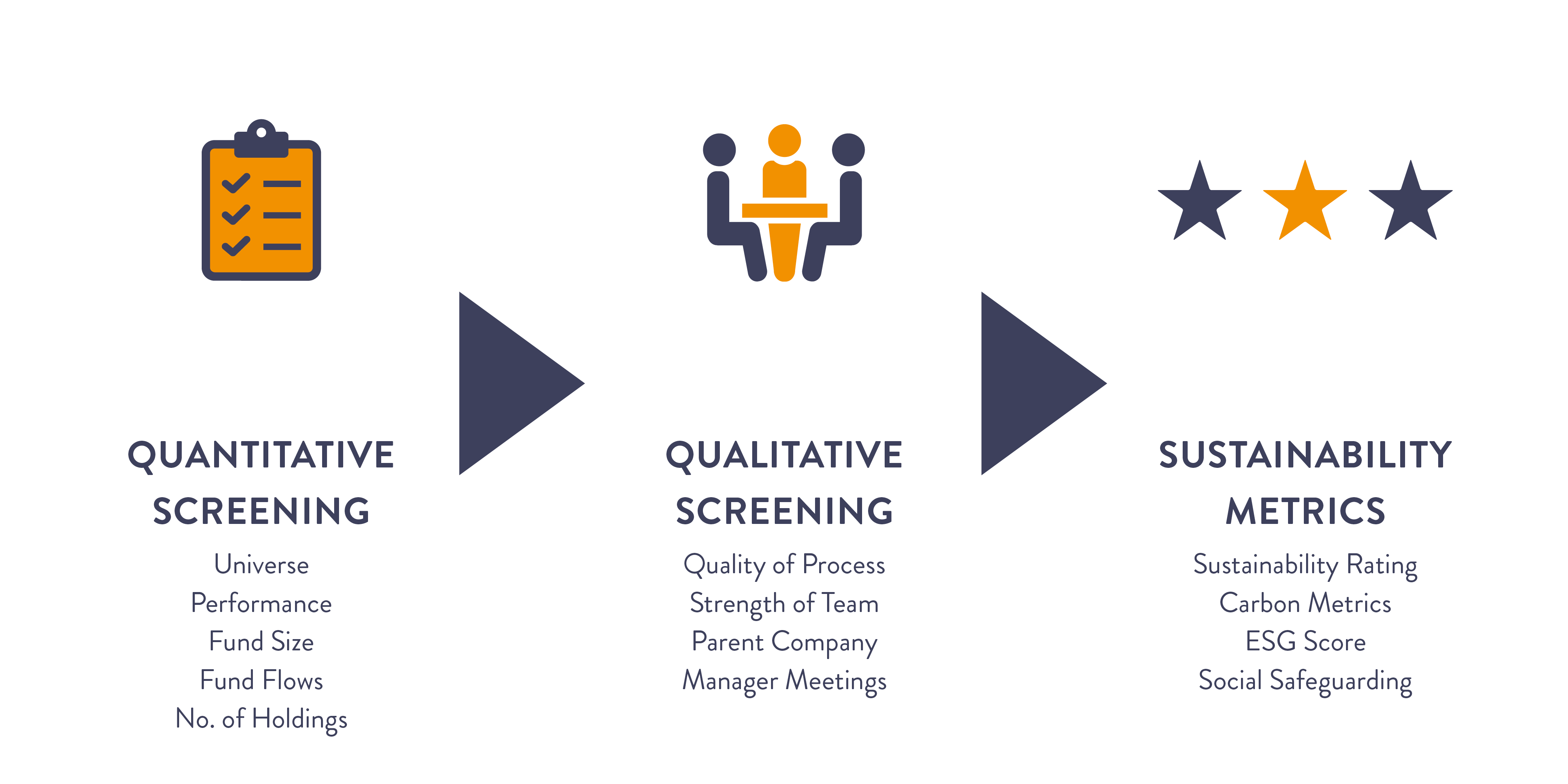

FUND SELECTION PROCESS

Our approach results in a diversified buy list that has a sustainable bias, without compromising our core asset allocation values.

The Bowmore portfolios are continuously monitored by our investment team to ensure the investment strategy and underlying holdings remain accurately aligned to each portfolio’s risk profile.

Production

Production