Market panic Stations over UK Inflation figures but economists remain calm

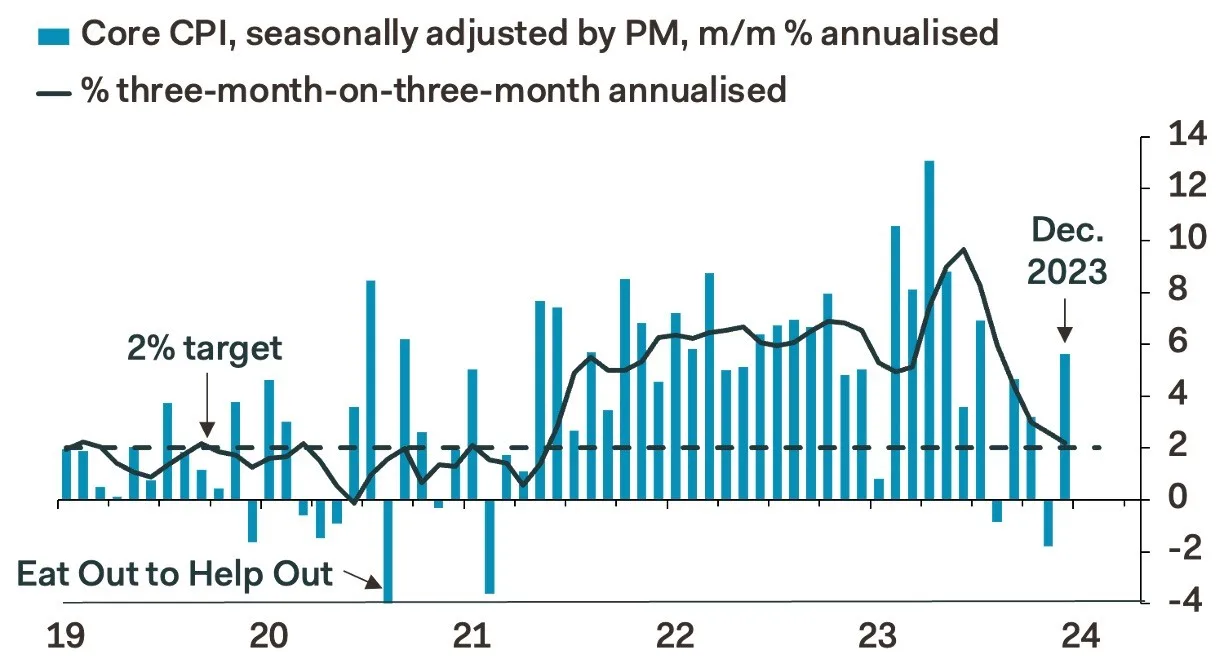

- PI inflation increased to 4.0% in December, from 3.9% in November. Consensus: 3.8%

- Core CPI inflation held steady at 5.1% in December. Consensus: 4.9%

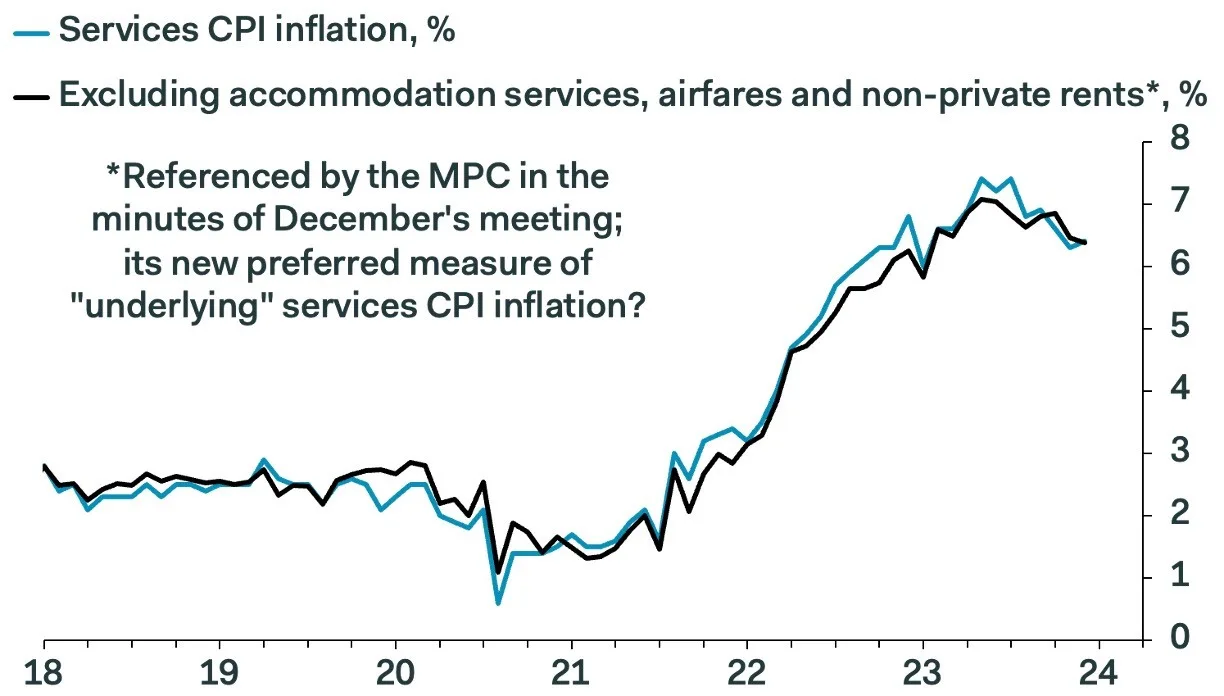

- Services CPI inflation increased to 6.4% in December, from 6.3% in November. Consensus: 6.1%

Source – Pantheon Macroeconomics

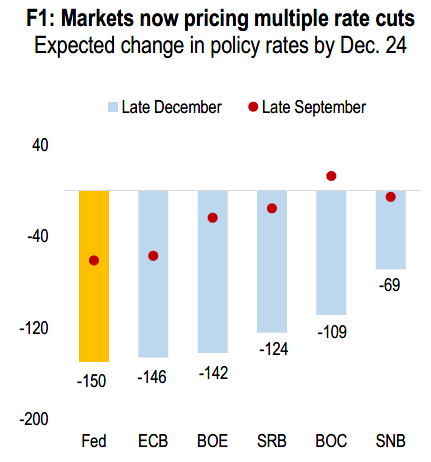

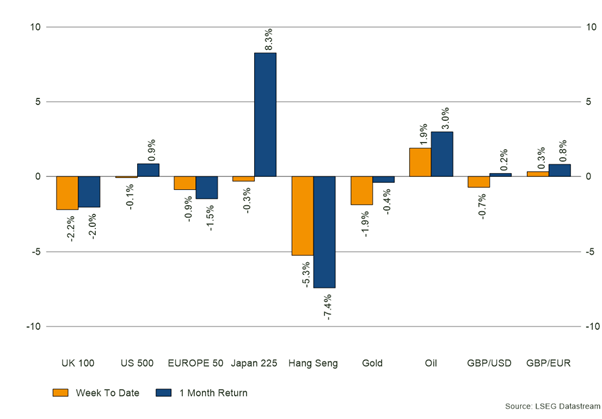

After a truly spectacular Santa Rally in December across all asset classes, we were all given a reminder that inflation has not gone away simply because the US federal Reserve suggested terminal rates have been reached in December 23. The US and the Eurozone all faced the same issue with inflation data and once again interest rate expectation is driving significant moves in the stock market. As rate expectations increase, the markets fall, conversely when expectations decline the market rises. Normal market behaviour is still elusive.

Consumer prices increased in December after November’s sharp drop, but the underlying trend undeniably weakened towards the end of 2023. We are not changing our view that inflation is on a downward trajectory and the detail behind the numbers shows that we had a large increase in airfares (which are volatile) along with higher tobacco duties. It is difficult to see these items causing ongoing significant further pressure on inflation as the year moves on. Reducing petrol prices, slowing food inflation and reducing wage growth are all far more significant and pointing to continued declines in inflation over the coming year.

Source – Pantheon Macroeconomics

The MPC’s new preferred measure of underlying services CPI inflation, which excludes non-private rents, accommodation prices and airfares as they are “not typically reliable indicators of trends in inflationary persistence”, slowed to 6.4% in December, from 6.5% in November, again suggesting that people should not panic over one months data.

Pantheon Macroeconomics suggests that inflation will likely fall below 2% in April and may reach a low of about 1.5% mid-way through the year. Falling energy costs (Ofgem is expected to make a 10% to 15% cut in tariffs for April) and a continued fall in producer output inflation will offset service gains. We also don’t know yet if we will see any impact from the 20% of shipping disruption resulting from the Red Sea avoidance of many shipping companies and so we expect the bank to remain cautious in its tone.

You can see in the below chart just how aggressively market expectations for rate cuts have moved from September 23 to December 23 and as with all sharp movements some pull back is expected. Rate cuts will still come through in the first half of the year and accelerate throughout the year, but the below market estimates do look a little over stretched in our view.

Based on FFR, ESTR, SONI, SARON and RIBA futures

Source MacroBond & Numera Analytics

Bowmore Portfolios

We have over the second half of 2023 started to position portfolios towards a peak of US interest rates and by definition a falling rate environment. This has worked well for us in November and December and we have indeed taken some profits from our smaller companies and higher beta investments, many of which made returns of over 10% in December. We took these before the release of the inflation data which raised cash by around 3%, ahead of market falls on the 16th January.

We have added new positions in UK corporate debt as we feel that some extra defensive allocations would be prudent as much uncertainty still exists. The yields on offer remain at the 5% level and are looking far more attractive than US or European debt. By taking this exposure we are being well paid to wait for the rate cuts to come and expect to benefit in capital terms (marginally) when interest rate cuts do start to take effect.

As stated above we think that UK inflation will fall sharply and hence we are happy to remain with our base case view that US rates will start to decline, the US dollar will weaken, and we expect the parts of the equity market that have been unloved for the last few years to start to recover as Price to earnings multiples look attractive with falling interest rates acting as the required catalyst.

Production

Production